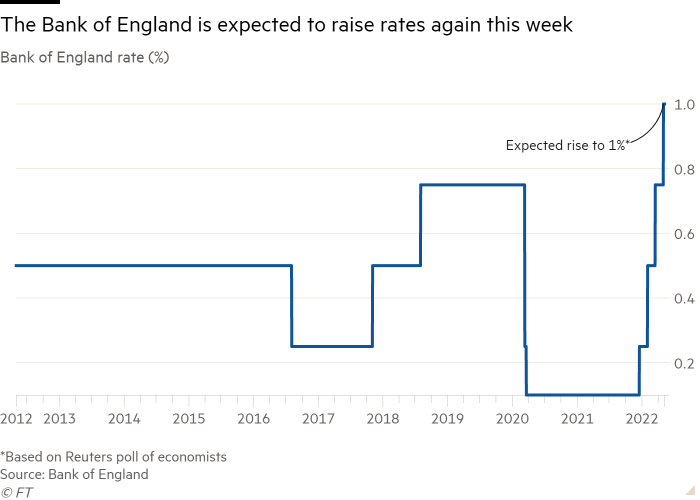

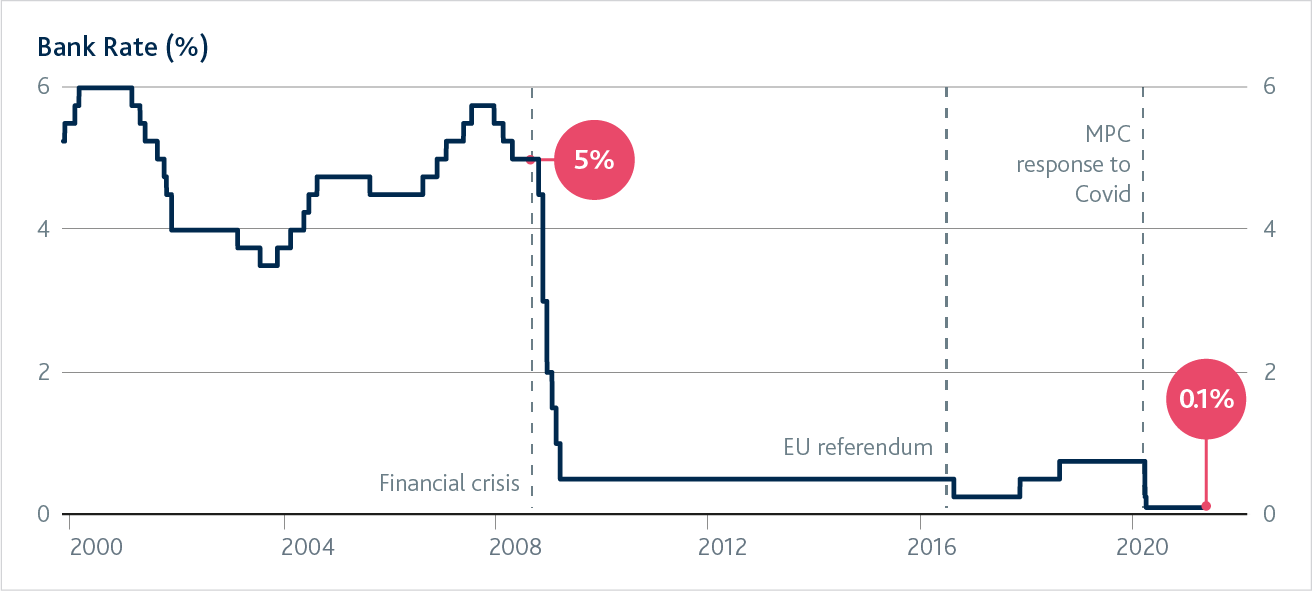

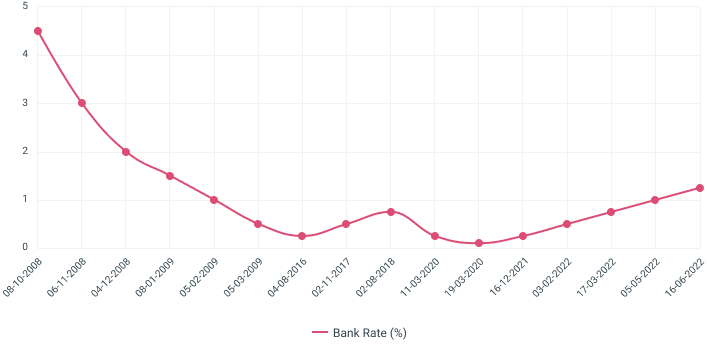

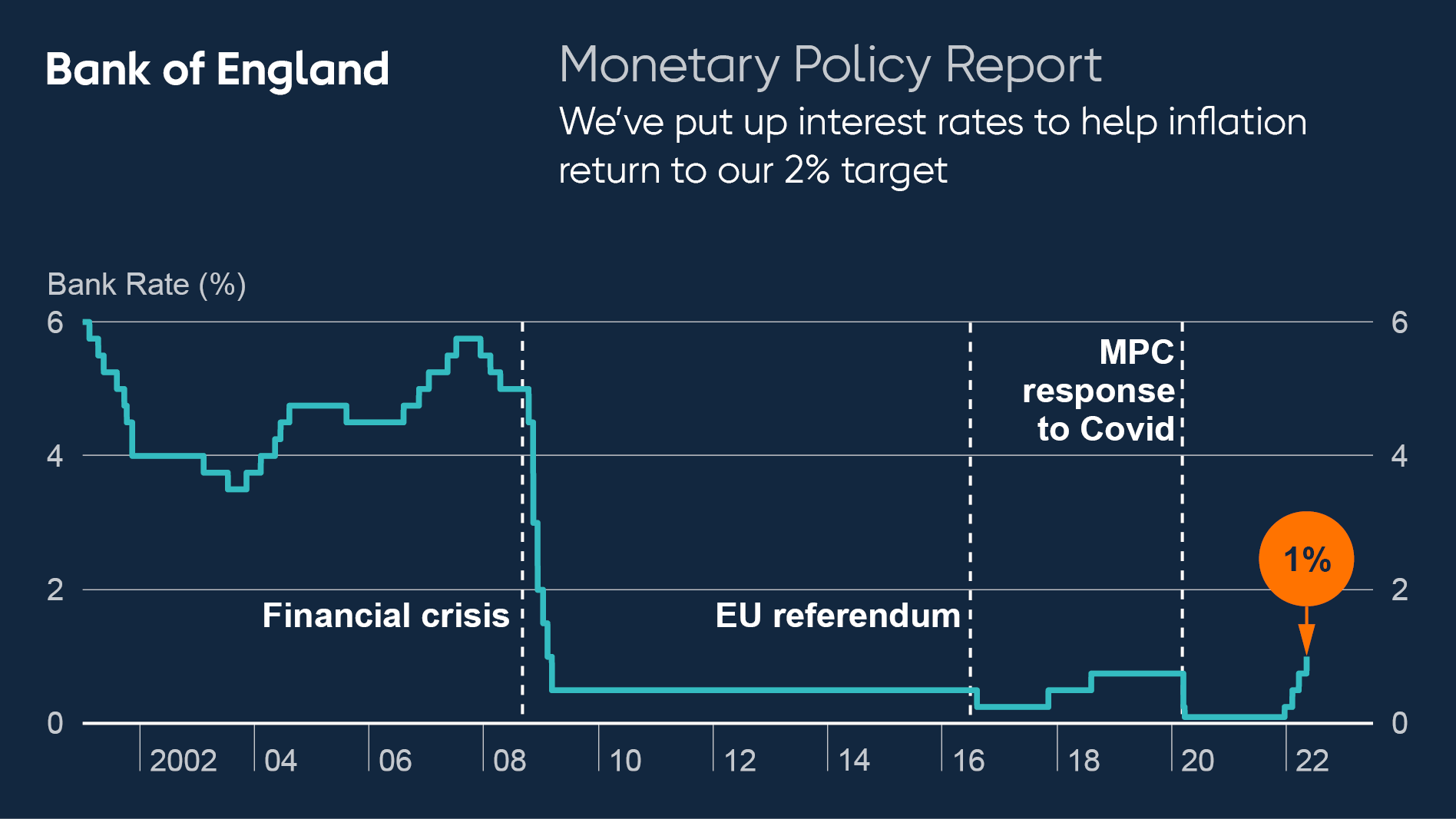

Bank of England on Twitter: "The Monetary Policy Committee voted to raise #BankRate to 1%. Find out more in our #MonetaryPolicyReport: https://t.co/h3ewfvAPYp https://t.co/I5q7mliWza" / Twitter

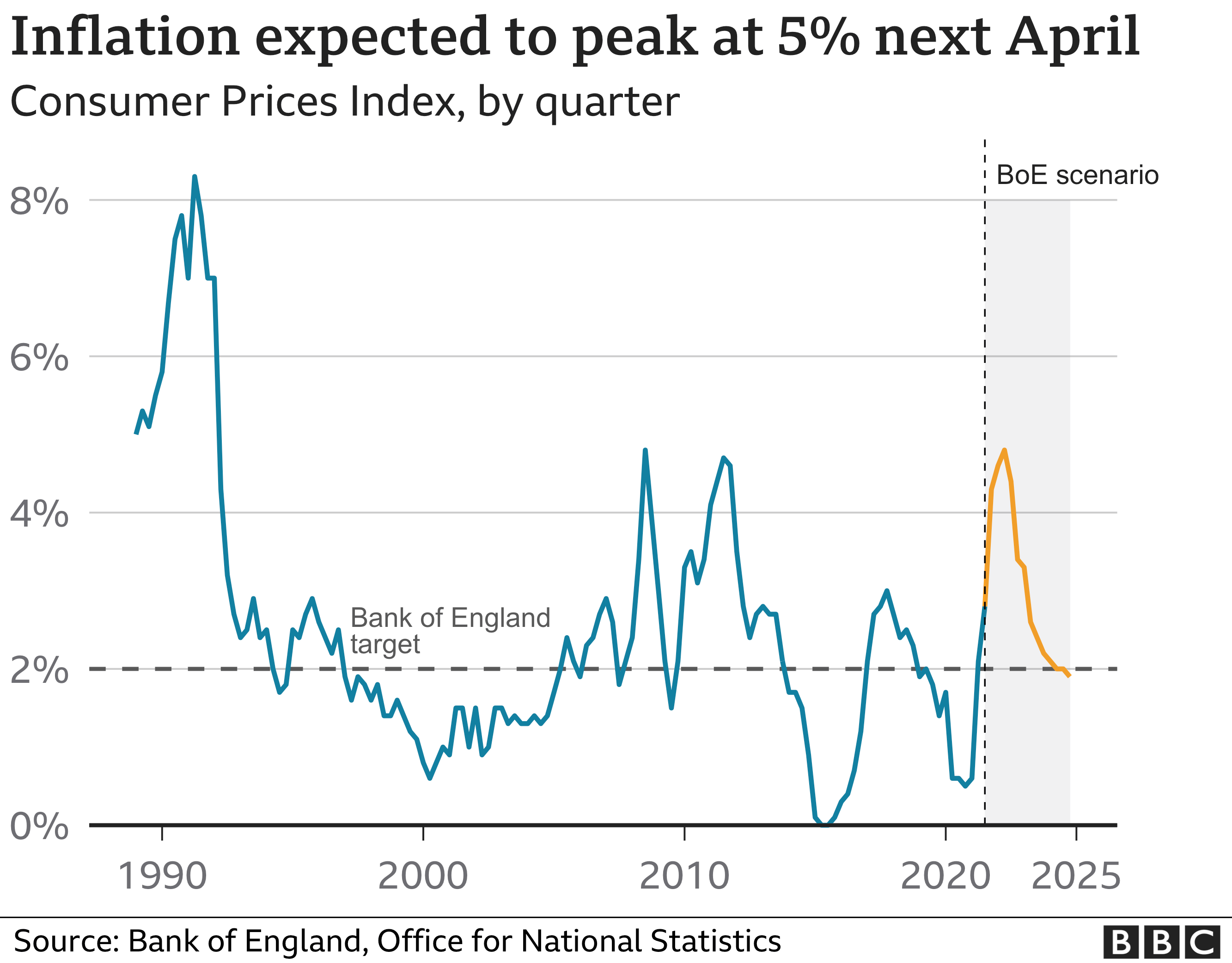

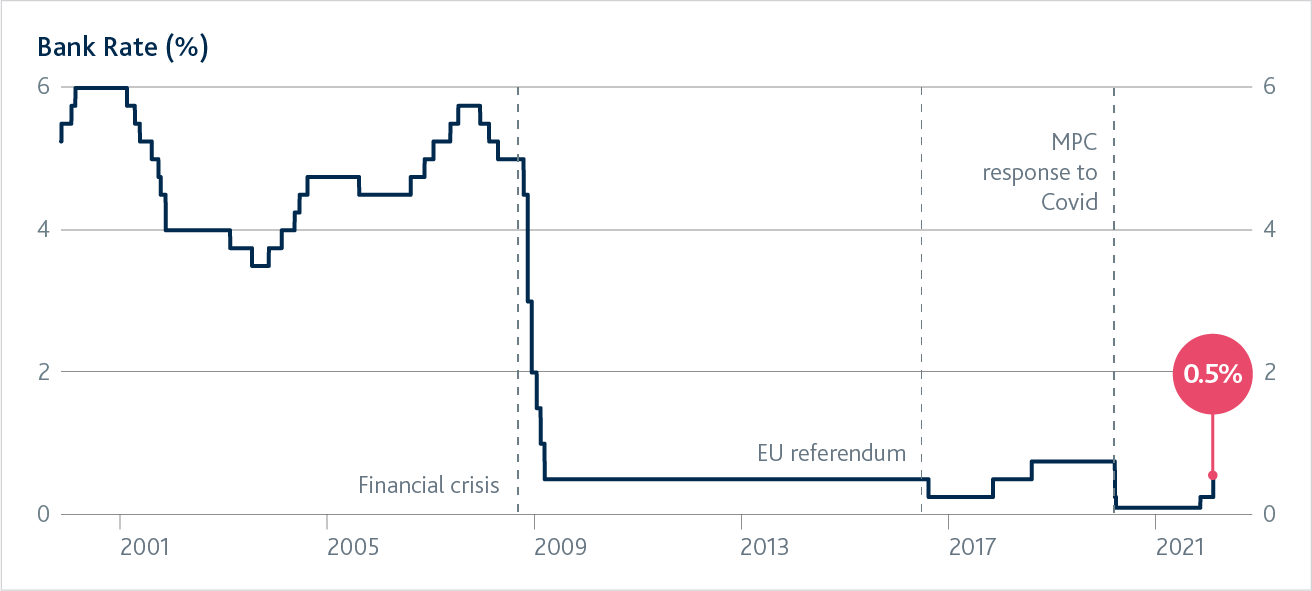

Bank of England poised to hike interest rates to 1.25% in battle against inflation | The Independent